沪深北交易所及港交所可持续发展报告披露规则对比(中英)

编辑: 时间:2025-09-11

9月5日,在证监会统一部署下,沪深北交易所同步就《可持续发展报告编制指南》新增三项环境议题应用指引公开征求意见,针对污染物排放、能源利用与水资源利用提出更具操作性的披露要求。此次修订在既有框架与气候披露的基础上,进一步夯实A股上市公司可持续发展信披制度体系,也体现出与港交所ESG规则颗粒度持续接轨的监管趋势。

随着ESG信披逐渐升级,企业如何精准理解政策、高效完成披露、强化ESG绩效管理,已成为影响投资者信任与品牌声誉的关键。新规之下,上市公司更应主动对标优秀实践,将合规披露转化为竞争力来源。本文将从沪深北与港交所ESG要求对比出发,为企业提供前瞻性实操建议。

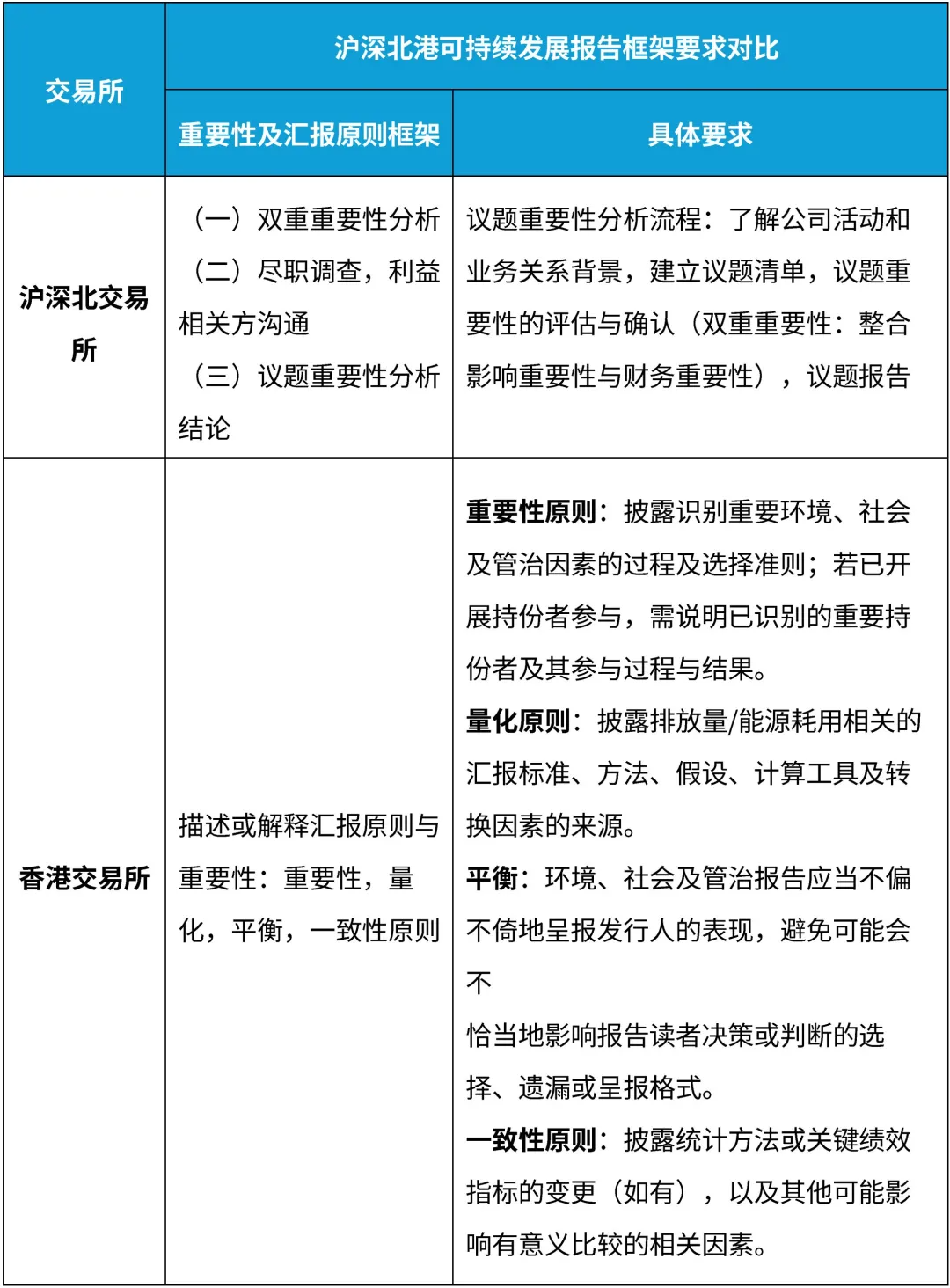

一.对重要性的理解

双重重要性的定义:

财务重要性是指议题是否预期在短期、中期和长期内对公司商业模式、业务运营、发展战略、财务状况、经营成果、现金流、融资方式及成本等产生重大影响。

影响重要性是指企业在相应议题的表现是否会对经济、社会和环境产生实际或者潜在重大影响。

港交所目前采用 “财务重要性”单维原则。对重要性的定义为:“当董事会厘定有关环境、社会及管治事宜会对投资者及其他持份者产生重要影响时,发行人就应作出汇报”,对于气候相关披露的重要性评估则依据“合理预期可能影响其短期、中期或长期现金流量、融资渠道和资本成本的气候相关风险和机遇”的原则。可以看出,港交所重要性的核心是从投资者及其他持份者的角度,关注ESG风险如何影响企业。

沪深北交易所则明确提出 “双重重要性”(Double Materiality)原则。这不仅要求评估ESG议题对企业财务的实质性影响(财务重要性),还要求评估企业活动对经济、社会、环境的重大影响(影响重要性), 体现了“Inside-out”与“Outside-in”的双重视角。

对比来看,港股更偏向投资者视角,关注ESG如何影响企业价值;A股新规则进一步与国际标准(如欧盟CSRD)接轨,要求企业同时审视自身对世界的影响,体现了更全面的责任观。长期来看,双重重要性的分析将成为全球可持续披露的新趋势,建议上市公司主动拥抱双重重要性原则,不仅应关注ESG议题对企业财务表现和风险的影响(财务重要性),还应系统评估企业运营对经济、社会及环境的实际与潜在影响(影响重要性)。这有助于更全面识别风险与机遇,提升长期韧性。

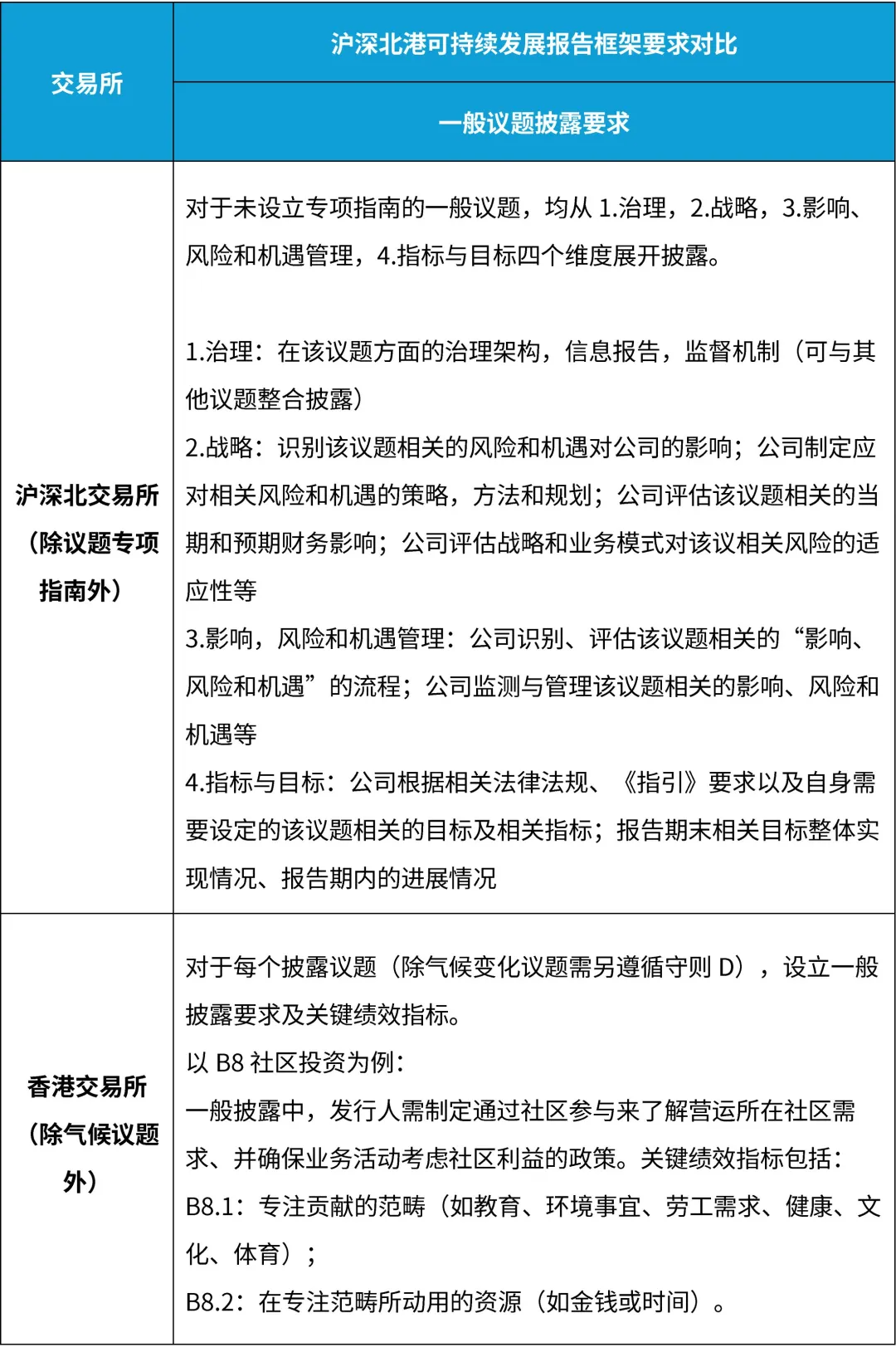

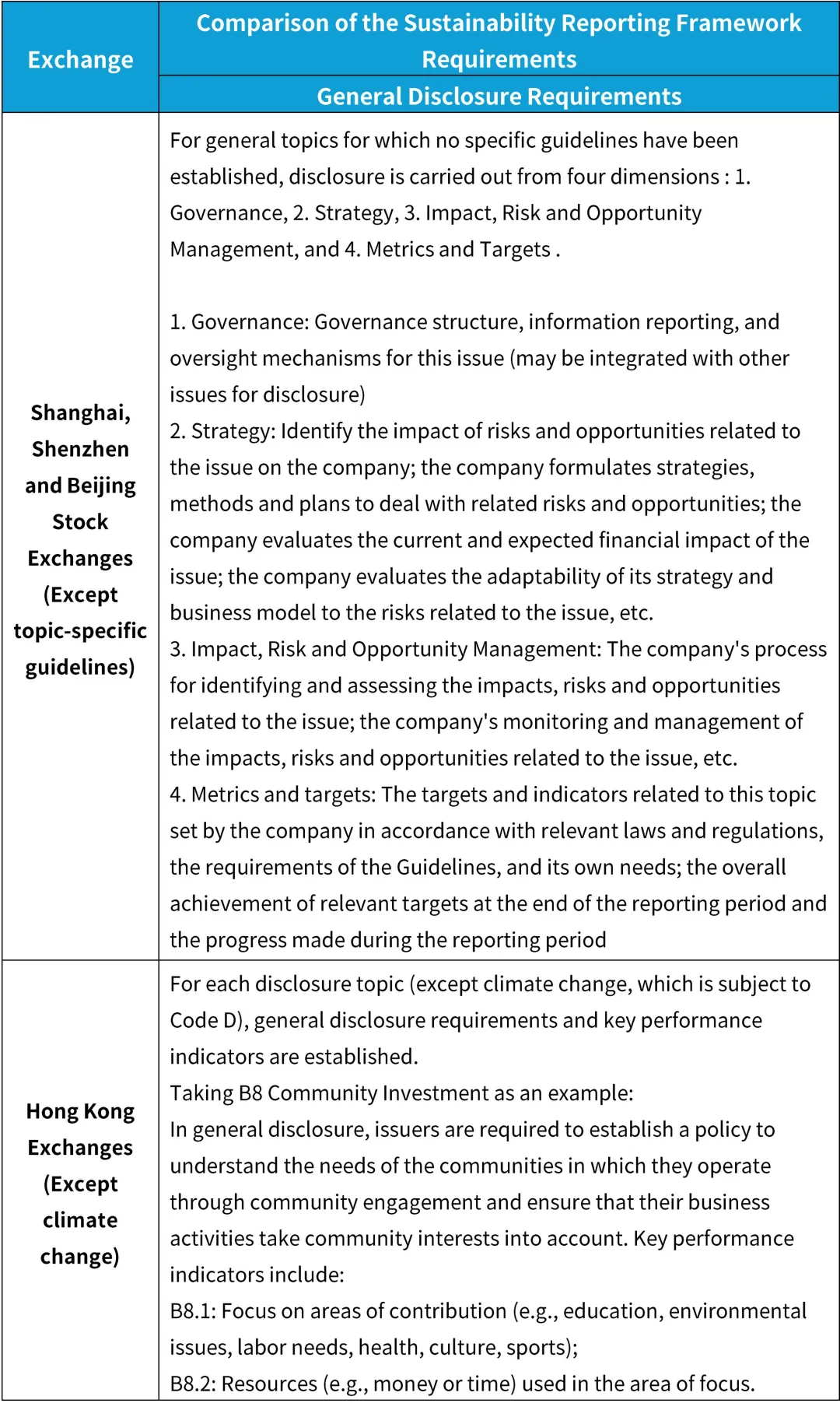

二.总体披露指标的颗粒度

在ESG信息披露实践中,港股与A股市场呈现出两种不同的框架思路。

港交所在ESG披露指引中,对每一个ESG议题(除气候变化议题需另遵循守则D),都规定了一般披露内容和相应的关键绩效指标(KPIs),构建了一套较为细致、落实到具体议题的披露体系。这种做法的优势在于明确性强,企业可按图索骥,逐项回应监管要求。例如在“产品责任”社会议题中,需具体汇报B6.1:已售或已运送产品总数中因安全与健康理由而须回收的百分比等关键绩效指标,体现出较强的颗粒度和可操作性。

反观沪深北交易所发布的指引,除已出台的四个细分议题指南外,并未对每个议题设置独立的披露结构和指标,而是借鉴了气候相关财务信息披露工作组(TCFD)框架,统一要求企业从1.治理,2.战略,3.影响、风险和机遇管理,4.指标与目标四个维度对所有ESG议题进行自主披露。这种模式不强求逐个议题细化,而是强调企业应建立系统性的管理逻辑,将ESG因素融入公司管治和战略决策中,体现出更强的结构性和整合性。

对于上市公司而言,沪深北及港股的框架,对于优化自身ESG披露质量,进一步提升ESG评级水平,均有很大的参考价值。上市公司应主动尝试以“双重重要性”和TCFD思维整合披露内容,提升ESG管理的战略高度;尽快搭建起覆盖治理、战略、风险与指标的内部制度体系,避免披露流于空泛,力求在自主框架中体现实质内容。

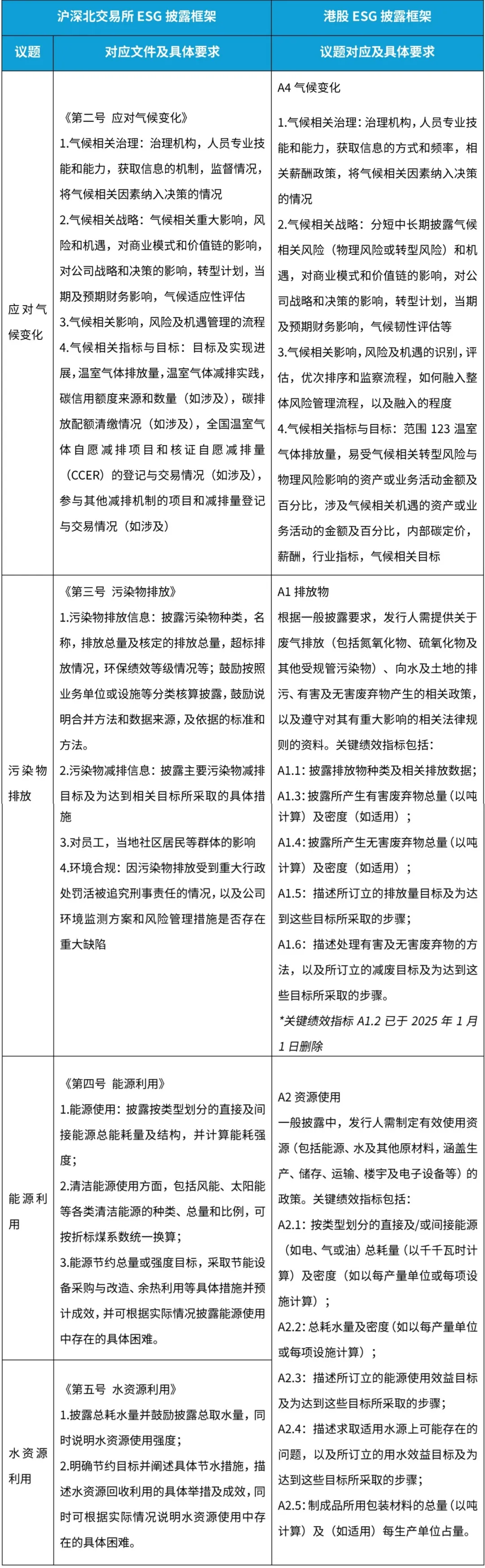

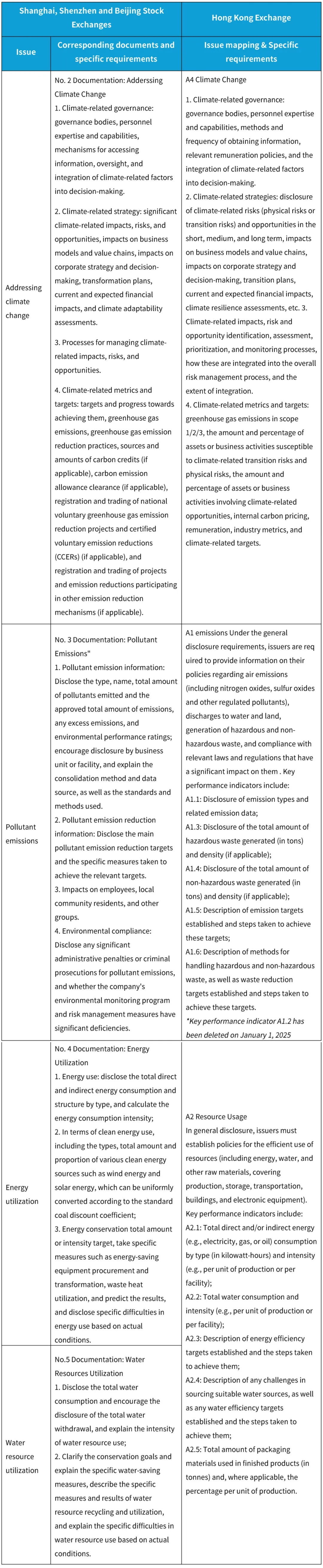

三.议题专项披露指南

沪深北交易所针对应对气候变化、污染物排放、能源利用与水资源利用四大议题推出了详细的披露指南(征求意见稿),显示出对环境议题系统性管理的高度重视,体现出更强调数据实质性和行动可验证性的倾向。港股在气候变化相关披露方面已基本与国际标准看齐,尤其通过引入与IFRS S2相衔接的汇报要求,强化了气候风险、转型计划、情景分析等内容。

在气候议题上,A股与港股的核心框架已基本趋于一致,在具体指标的上存在区别。而针对污染物排放、能源利用与水资源利用议题,沪深北交易所通过征求意见稿推出了更全面的披露框架,旨在推动企业加强环境内部管理、实现绿色转型。

两地上市公司均需重视气候相关披露与IFRS S2的合规对接,强化战略韧性和风险应对的沟通。A股上市公司应重点关注污染物、能源与水资源的量化管理、目标设定与实施路径披露,建立系统数据收集机制;港股企业虽在非气候环境议题披露压力较小,但仍可参照A股或国际标准自愿提升相关披露,以提升ESG评级与国际可信度。

在可持续发展日益成为全球共识的今天,无论是A股的细化要求,还是港股的国际对标,都推动企业更实质地管理并披露其环境影响。披露已超越合规本身,成为企业展现责任、透明与战略韧性的核心方式。顺应趋势、主动融入,方能在新的市场规则中赢得信任,走向长远。

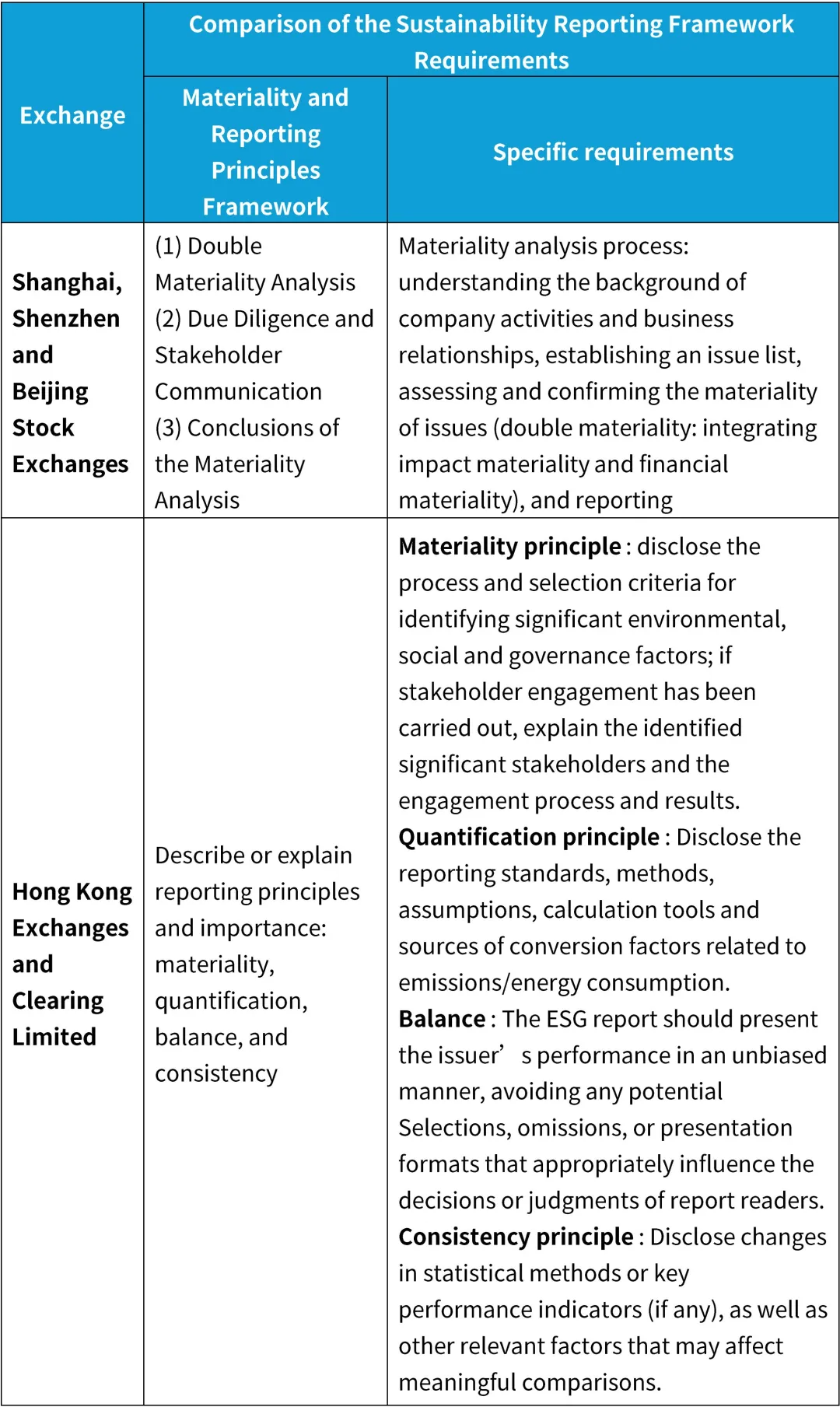

Comparison of Sustainability Report Disclosure Rules of the Shanghai-Shenzhen-Beijing, and Hong Kong Stock Exchanges

On September 5th, under the unified guidance of the China Securities Regulatory Commission, the Shanghai, Shenzhen, and Beijing Stock Exchanges simultaneously solicited public comment on three new environmental guidelines for the "Sustainability Reporting Guidelines". These guidelines introduce more practical disclosure requirements for pollutant emissions, energy use, and water resource utilization. Building on the existing framework and climate disclosure framework, these revisions further strengthen the sustainability disclosure system for A-share listed companies and reflect a regulatory trend toward aligning the granularity of ESG rules with those of the Hong Kong Stock Exchange.

As ESG disclosure continues to evolve, how companies accurately understand policies, efficiently complete disclosures, and strengthen ESG performance management has become crucial for investor trust and brand reputation. Under the new regulations, listed companies should proactively benchmark against best practices and transform compliant disclosures into a source of competitiveness. This article will compare the ESG requirements of the Shanghai-Shenzhen-Beijing, and Hong Kong Stock Exchanges, offering forward-looking, practical advice for companies.

1.Understanding of Materiality

Definition of Double Materiality:

Financial materiality refers to whether the issue is expected to have a significant impact on the company's business model, business operations, development strategy, financial position, operating results, cash flow, financing methods and costs in the short, medium and long term.

Impact materiality refers to whether a company's performance on the corresponding issue will have actual or potential significant impact on the economy, society and the environment.

The Hong Kong Stock Exchange (HKEX) currently uses a single-dimensional principle of "financial materiality." Materiality is defined as "when the board determines that environmental, social, and governance (ESG) matters are material to investors and other stakeholders, the issuer should report them." Materiality assessment for climate-related disclosures is based on "climate-related risks and opportunities that could reasonably be expected to affect its short-, medium-, or long-term cash flows, access to financing, and cost of capital." This suggests that the core of the HKEX's materiality approach is focusing on how ESG risks impact companies from the perspective of investors and other stakeholders.

The Shanghai, Shenzhen, and Beijing Stock Exchanges have explicitly proposed the "Double Materiality" principle. This requires not only an assessment of the substantive impact of ESG issues on a company's financiales (financial materiality), but also an assessment of the significant economic, social, and environmental impacts of a company's activities (impact materiality), embodying both an "inside-out" and "outside-in" perspective.

Hong Kong stocks tend to favor an investor perspective, focusing on how ESG impacts corporate value, while new A-share rules further align with international standards (such as the EU's CSRD), requiring companies to simultaneously examine their own impact on the global economy, reflecting a more comprehensive perspective on responsibility. In the long term, double materiality analysis is likely to become a new trend in global sustainability disclosure. Listed companies are advised to proactively embrace the double materiality principle, focusing not only on the impact of ESG issues on financial performance and risks (financial materiality) but also systematically assessing the actual and potential impact of their operations on the economy, society, and the environment (impact materiality). This will help the companies to identify risks and opportunities more comprehensively and enhance long-term resilience.

2.Granularity of overall disclosure metrics

In the practice of ESG information disclosure, the Hong Kong stock market and the A-share market present two different framework ideas.

The Hong Kong Stock Exchange's ESG Code specifies general disclosure content and corresponding key performance indicators (KPIs) for each ESG topic (except climate change, which is subject to Code D). This establishes a detailed, topic-specific disclosure framework. The advantage of this approach lies in its clarity, allowing companies to follow the guidelines and respond to regulatory requirements item by item. For example, within the " Product Responsibility " social topic, specific KPIs are required to be reported, such as B6.1: The percentage of products sold or shipped subject to recall for safety and health reasons . This demonstrates a high level of granularity and actionability.

In contrast, the guidelines issued by the Shanghai, Shenzhen, and Beijing Stock Exchanges, beyond the four already-issued guidelines for specific topics, do not establish independent disclosure structures and indicators for each topic. Instead, they draw on the framework of Task Force on Climate-related Financial Disclosures (TCFD), uniformly requiring companies to voluntarily disclose all ESG issues across four dimensions: 1. Governance; 2. Strategy; 3. Impact, Risk, and Opportunity Management; and 4. Metrics and Targets. This approach avoids requiring detailed granularity for each topic, instead emphasizing that companies should establish a systematic management logic and integrate ESG factors into corporate governance and strategic decision-making, demonstrating a more structured and integrated approach.

For listed companies, the frameworks of the Shanghai, Shenzhen, Beijing, and Hong Kong stock exchanges offer valuable insights into optimizing their ESG disclosures and further enhancing their ESG ratings. Listed companies should proactively explore integrating disclosure content with a "double materiality" and TCFD-four-pillar mindset to elevate the strategic focus of ESG management. They should also quickly establish internal systems encompassing governance, strategy, risks, and metrics, avoiding superficial disclosures and striving to reflect substantive content within their own frameworks.

3.Guidelines for Issue-specific Disclosure

The Shanghai, Shenzhen, and Beijing Stock Exchanges have released detailed disclosure guidelines (draft for public comment) addressing four key areas: climate change response, pollutant emissions, energy utilization, and water resource utilization. These guidelines demonstrate a strong commitment to systematic management of environmental issues and a stronger emphasis on material data and verifiable actions. Hong Kong stocks are already largely aligned with international standards in climate change disclosures, particularly through the introduction of reporting requirements aligned with IFRS S2, which strengthen coverage of climate risks, transition plans, and scenario analysis.

On climate change, the core frameworks for A-shares and Hong Kong-listed stocks are largely consistent and aligned with IFRS S2 , though specific indicators differ. Regarding pollutant emissions, energy use, and water resource utilization, the Shanghai, Shenzhen, and Beijing Stock Exchanges have introduced a more comprehensive disclosure framework through a draft for public comment, aiming to encourage companies to strengthen internal environmental management and achieve green transition.

Listed companies in both A-share and H-share must prioritize the alignment of climate-related disclosures with IFRS S2 compliance, strengthening communication on strategic resilience and risk management. A-share listed companies should also prioritize the quantitative management of pollutants, energy, and water resources, target setting, and disclosure of implementation paths, and establish systematic data collection mechanisms. While Hong Kong-listed companies face less pressure to disclose non-climate environmental issues, they can still voluntarily enhance relevant disclosures, referencing A-share or international standards, to enhance their ESG ratings and international credibility.

As sustainable development becomes increasingly a global consensus, both A-share and H-share are driving companies to more substantively manage and disclose their environmental impacts. Disclosure has transcended compliance itself, becoming a core way for companies to demonstrate responsibility, transparency, and strategic resilience. Only by adapting to these trends and proactively integrating can companies earn trust and achieve long-term success within the new market rules.

作者:孙可仪

审核:沈双波